Palo Alto-based Zeni has introduced Zeni Treasury, a cash management solution aimed at enhancing liquidity and operational flexibility for businesses. This platform enables companies to earn market-leading yields on their cash reserves, outperforming conventional checking and savings accounts.

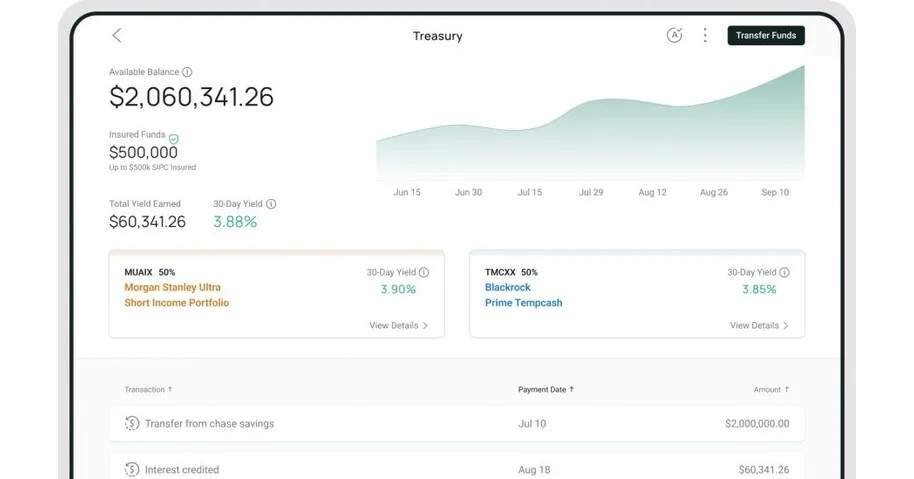

Key features of Zeni Treasury include no minimum balance requirements and instant access to funds, making it user-friendly for various businesses. The offering allows clients to invest in diversified money market funds managed by SEC-registered Atomic Invest LLC, focusing on low-risk assets like U.S. Treasuries.

With this launch, Zeni aims to address the common issue of underutilized capital in business accounts. Snehal Shinde, Zeni's CPO and Cofounder, emphasized that the platform helps businesses maximize returns without compromising liquidity. The integration with Zeni's AI-powered platform facilitates seamless tracking of financial operations, including bookkeeping and cash management, all from a single dashboard.

Existing customers can access Zeni Treasury through their current dashboard, while new users can quickly establish accounts within minutes.