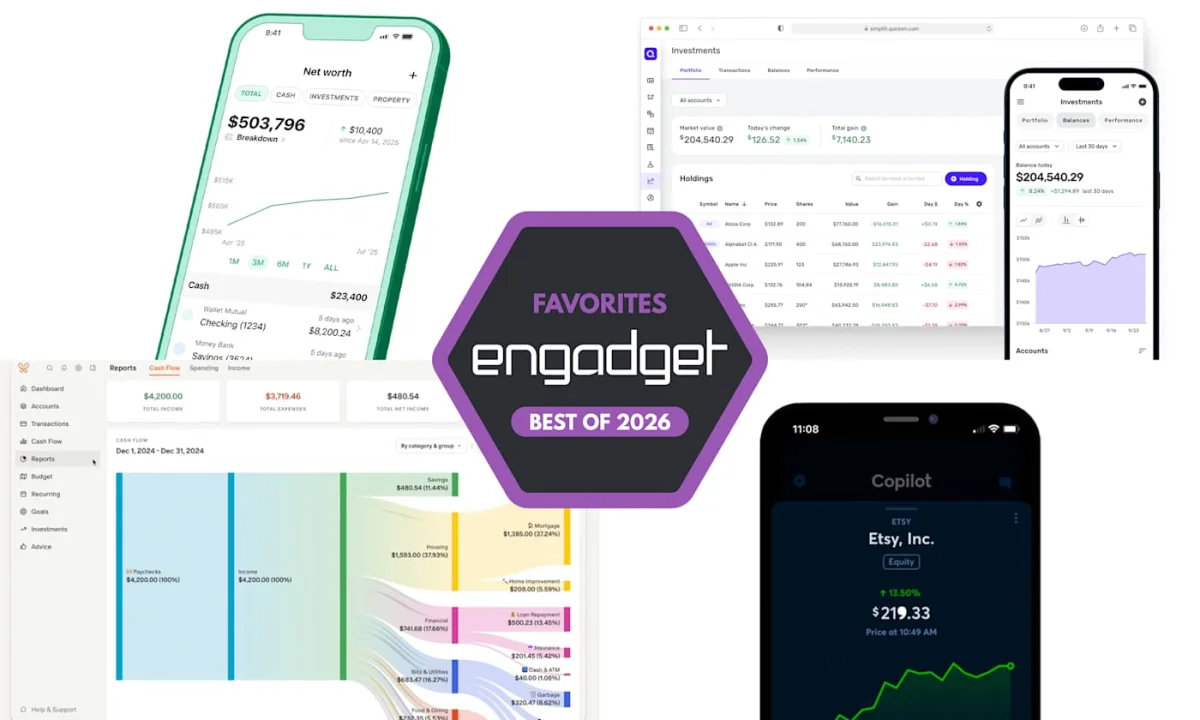

The budgeting app Quicken Simplifi has gained attention for its user-friendly design and robust features. Users can easily view their financial statistics including net worth, spending habits, and upcoming payments on a single, scrollable landing page. The application supports setting savings goals and allows users to invite a spouse or financial advisor to co-manage their accounts, a feature not commonly found in all budgeting tools.

While Simplifi connects seamlessly with Fidelity, it lacks integration with Zillow, requiring users to manually input real estate assets. Despite some miscategorization of expenses, the app stands out for its unique ability to mark transactions as expected refunds and its more accurate income estimation compared to competitors. The budgeting feature allows users to categorize specific purchases as recurring payments, enhancing flexibility in managing finances.

Overall, Quicken Simplifi provides a straightforward approach to budgeting, emphasizing clarity in financial tracking and management. Users should ensure their income and payment setups are accurate to make the most of its functionalities.