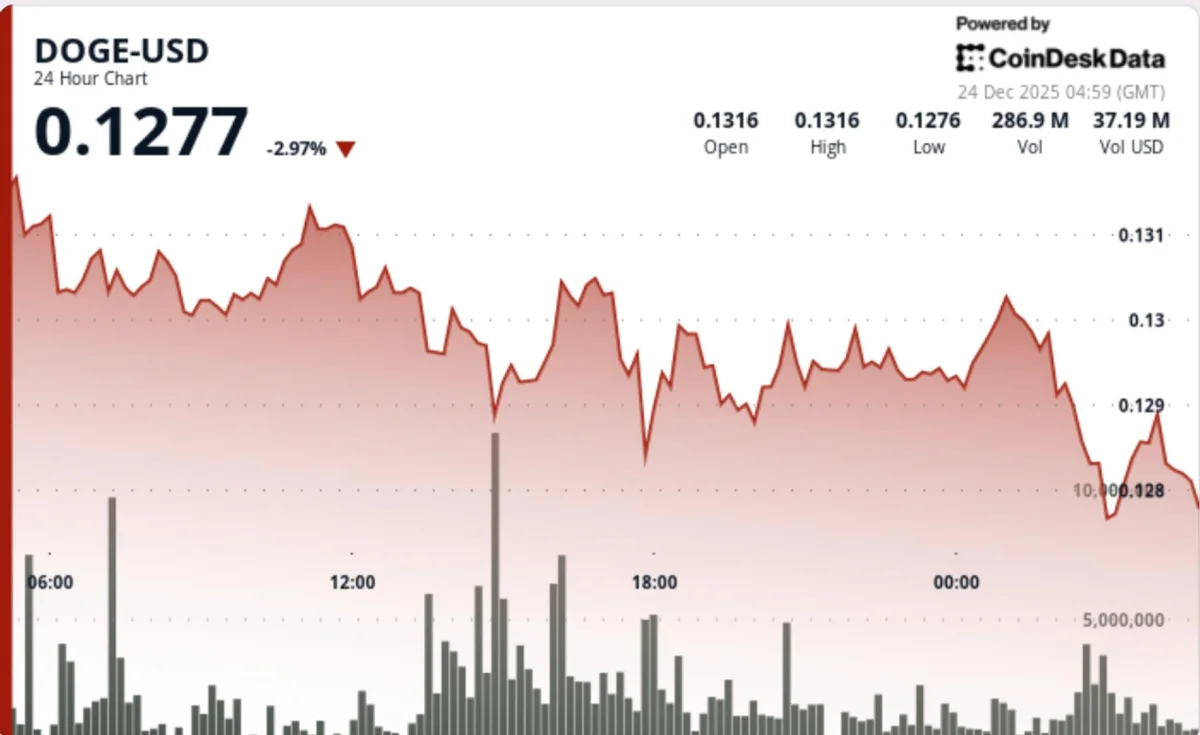

On Tuesday, Dogecoin (DOGE) dropped below the critical $0.13 mark, with a significant sell-off in the spot market contributing to this decline. The price fell by 2.3%, moving from $0.1323 to $0.1292 over a 24-hour period. This downturn was marked by a surge in trading volume, particularly reaching 639 million tokens at 16:00, which was approximately 101% above the session’s average.

Concurrent with the price decline, BitMEX reported a staggering 53,000% increase in Dogecoin futures volume, totaling $260 million. This uptick indicates that traders are anticipating heightened volatility in the market. The intraday trading showed a further decline as DOGE struggled against interim support levels at $0.1295 and $0.1292, forming a descending channel structure.

If Dogecoin can reclaim the $0.13 level, it may lead to a short-covering bounce toward $0.1320. However, failing to hold this floor could push the price down to the next demand cluster between $0.1285 and $0.1280, where buyers might seek to re-enter the market.